Take Charge of Your Practice’s Financial Health

Date: 8|25|2023

Are you a home-based medical care provider or practice administrator feeling overwhelmed with the complexities of Revenue Cycle Management (RCM)? Do you find it challenging to understand RCM, including how to effectively delegate tasks to your staff? Kera Holmes, HCCI, Manager of Practice Development, can help you unravel the mysteries of RCM and equip you with the knowledge to manage it like a pro. Following, Holmes shares how to take charge of your practice’s RCM using the five W’s and one H approach.

What is Revenue Cycle Management?

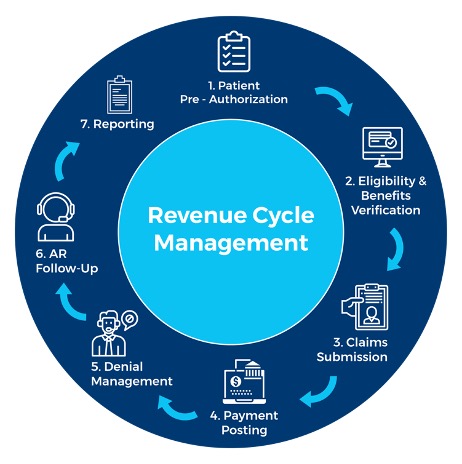

Revenue Cycle Management is a financial process home-based medical providers and practice administrators use to ensure the financial well-being and sustainability of their practice. It involves efficiently managing the lifecycle of patient care, from initial appointment scheduling to receiving payment for services rendered. While the steps in the process may vary depending on the organization’s size and model, some common stages include the following:

- Initial contact with patients and appointment scheduling

- Verification and authorization of insurance coverage

- Clinical documentation and encounter

- Coding, compliance, and charge entry

- Claims submission to payers

- Remittance processing (payment or denial)

- Payment posting, or denials and appeals

- Accounts receivable and follow-up

- Patient statements and payment reconciliation

- Generating reports for analysis and decision-making

Where should the primary focus be for a successful revenue cycle?

By closely monitoring claims status (rejected, denied, paid, or partially paid), you can identify areas of improvement and optimize processes in your practice. For instance, inadequate documentation might lead to medical record requests from payers, or missing information could hinder submissions. By improving the back-end operations, you pave the way for better decision-making and overall success for your practice.

Why is Revenue Cycle Management so important?

In simple terms, RCM is the lifeline of your practice. Every step within the RCM process exists for the purpose of reimbursement, which supports practice sustainability. It ensures that you receive fair compensation for the services you provide to your patients. Without effective RCM, your practice might struggle to survive, impacting not only your financial stability but also your ability to provide quality care. A streamlined RCM process is essential for the success, sustainability, and potential growth of the practice.

When does the revenue cycle begin?

The revenue cycle begins at the first point of contact with the patient, typically during appointment scheduling. For home-based medical care, this is most often in the form of a phone call and could be conducted with a family member or designated caregiver.

It continues throughout the patient’s journey, encompassing all the steps until reimbursement is received for the services rendered. However, if an appointment is scheduled but canceled before receiving care, the revenue cycle has not fully been entered. Once the initial visit is completed, this marks the beginning of the revenue cycle. Frequent cancellations may warrant investigation, as they can impact the revenue cycle’s efficiency and cash flow.

Kera Holmes

Who is involved in the Revenue Cycle Management process?

If you are wondering who is involved in the revenue cycle and has a responsibility to assist with the process, the short answer is “everyone” The success of your RCM process depends on the collaboration of every individual within the practice.

Patients must provide accurate demographic and insurance information, front-office staff needs to ensure timely and precise data entry and eligibility verification, and clinical staff should document comprehensive and accurate patient information. The back-office team also plays a vital role in coding compliance and accuracy, claims submission, and follow-ups.

Yes, RCM is a team effort, and each step in the process should have a designated “owner” to ensure smooth operations. There is no “one size fits all” staffing model, and the number of staff may vary by practice. Therefore, you may find that you need to split or outsource roles and responsibilities. No matter the model or size of your practice, make sure each step in the revenue cycle has a designated owner and established processes for efficient operations.

How do you manage and maintain a healthy revenue cycle for your practice?

Whether you are at the beginning stages of implementing RCM for a new practice or looking to improve on your existing process, here are some tips:

Leadership

- Regularly review RCM metrics, such as claim submission speed, rejection rate, denial reasons, and reimbursement amounts. If your practice uses a third-party billing department, it is imperative that you include it in this analysis. Here are some questions you should ask about your metrics:

- Are claims being submitted in a timely manner?

- Are claims being rejected? If so, why?

- Are claims being denied? If so, why?

- Are reimbursements from payers aligned with the agreed amount in the contract?

- Run reports weekly to track the following:

- Accounts receivable

- Denial rates

- Cancellations vs. rescheduling

- Denials percentage (5% to 10% is the average[1])

- If reimbursement from payers is low, consider renegotiating contracts.

Staff

- Assign an owner of specific steps in the process to clearly designate which staff members will handle what tasks to avoid confusion and redundant work.

- Create a visual presentation of the process to ensure staff members understand their responsibilities clearly to eliminate any confusion.

- Hold regular meetings specific to RCM and discuss the process, identify areas for improvement, and implement changes.

- Utilize an efficient and intuitive EHR/Practice Management system that accommodates the needs of your practice.

External – Patient

- Gather all necessary patient information during the initial contact.

- Verify insurance eligibility and patient responsibility immediately.

- Ensure referrals and authorizations are obtained and documented in the patient’s EHR.

- Collect all payments up front when applicable to reduce payment delays.

Now that you have a better understanding of Revenue Cycle Management, you can confidently take charge of your practice’s financial health. Remember, a well-managed revenue cycle not only benefits your bottom line but also enhances patient satisfaction and the overall well-being of your practice.

HCCI can help your practice improve its RCM and more. For details, contact Kera Holmes, Manager of Practice Development.

[1] Per American Academy of Family Physicians, a 5% to 10% denial rate is the industry average, but keeping the denial rate below 5% is more desirable.